Published on: 11/28/2024

For aspiring founders, it is good to be in spaces with a lot of activity - we can use public finance data for finding those spaces

There are several themes that repeat often in startup literature. One of those themes is that picking a market is very important. Jason Cohen advises on picking a large enough market, Rob Walling says: “Market comes first, marketing second, aesthetic third, and functionality a distant fourth” and VCs mention fast flowing waters. So, how do we actually find out which markets are large?

To make that statement actionable, we should define some metrics to measure:

What is big is a relative term - enterprise customers are much bigger spenders than customers of mobile apps. What numbers we use also depends on our goals - if we are trying to build a consultancy then current size is very important. If we are trying to build the biggest company in the world, we probably need to bet on future growth.

This HubSpot article talks about estimating market sizes in terms of customers. In this post the focus is more on leveraging publicly available data to make reasonable guesses on which places are high-growth.

A market is a collection of similar buyers. For example - every knowledge worker is a target customer of OpenAI’s ChatGPT, and every company that has its own R&D is a potential customer of GitHub’s Copilot.

If you are a solo founder like me, going into a large market can be useful. While all the other big players are targeting and competing for a big slice of the market, we can niche down to a very specific and underserved slice of it.

Capterra and G2 have reviews of companies in different industries and is good for finding the biggest players in a category.

YCombinator and Sequoia Capital publicly show which companies they have funded.

ProductHunt is a place where new companies announce themselves, it also has proxy metrics on how big the launch was.

For finding out generic answers, there are many groups publishing research reports. Depending on what we search for, data varies and it’s not clear-cut how to estimate different industry sizes.

Some examples:

For non-public companies, it might take effort to dig through the noise - for example everybody has estimates and comments on OpenAI numbers, but the proper finances are probably hidden. Depending on our needs (e.g. earning money on stocks), we might want to dig and triangulate numbers in private companies such as here. If we just want to learn what the big markets currently are, we can take the total company evaluations (from e.g. Crunchbase) as the single datapoint on those companies. Other similar aggregators of data are PitchBook and AngelList, although none of them are free sources.

Public companies are easies than private ones:

These are usually posed on company websites and can be found through a simple search.

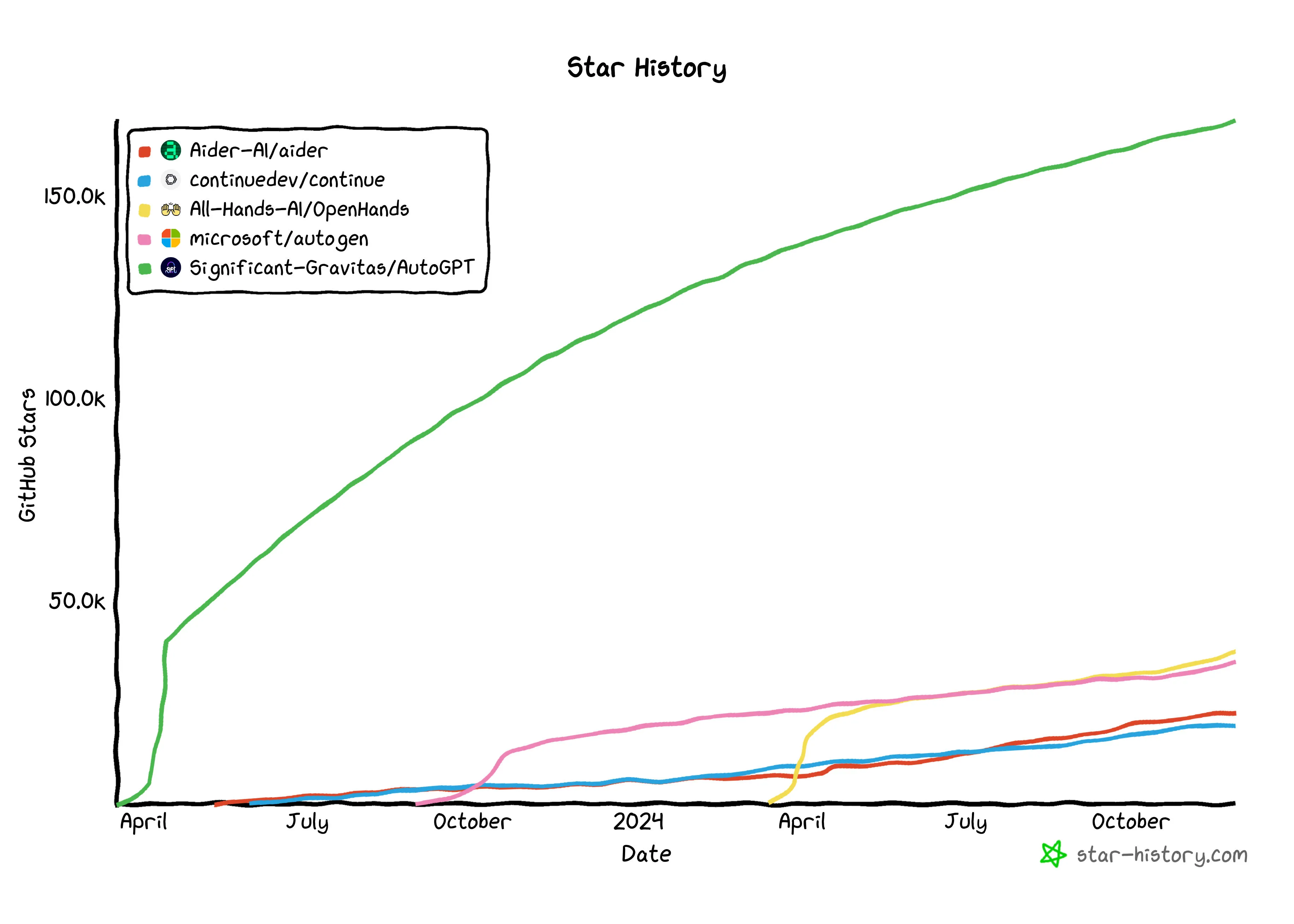

Number of forks or number of stars on GitHub.

Project management software

Hardware

AI agents and coding tools.

Email marketing

We can see that the AI boom is represented well in this data - hardware companies have crazy big growth, AI coding tools have big growth, project management software is having solid increases, while email marketing is not growing that fast.